China’s recent announcement to mass produce humanoid robots by 2025 may seem like the beginning of a dystopian sci-fi movie. To China’s leaders, keen to elevate the country into an advanced industrial nation, it is anything but. Industrial robots are a pivotal element of China’s ambition to become a high-tech manufacturer, detailed in state-led industrial policies like Made in China 2025 (中国制造 2025). Moreover, they are increasingly necessary to mitigate the effect of China’s unfavourable demographics on the manufacturing sector. The interest in robots comes from the very top: President Xi Jinping in a speech to the Chinese Academy of Social Sciences in 2014 emphasised a “robot revolution” to transform China’s manufacturing. More recently, during his visit to the Shanghai Futures Exchanges in early December 2023, he asked one robot company executive if it would be possible to speak with the humanoid robot on display. Whether or not humanoid robots can converse with humans in the future, China is counting on industrial robots to transform its factories and offset the limited availability of labour resources.

Driving Adoption

Industrial robotics have received greater political support and public attention than any other manufacturing technology in China. Their status as a strategic sector resulted in industrial policies over the last decade subsidising the adoption of industrial robots in the automobile, electronics, and pharmaceutical sector. It began with the Twelfth Five Year Plan for Intelligent Manufacturing (智能制造科技发展“十二五”专项规划) in 2011 which was followed by the Guideline on Promoting the Development of the Industrial Robot Industry (工业和信息化部关于推进工业机器人产业发展的指导意见) in 2013. These policies were furthered by the Made in China 2025 initiative in 2015, the Robotics Industry Development Plan (2016-2020) (机器人产业发展规划) and the Robot + Application Action Plan (机器人+应用行动方案) that outlined the development of the industry.

Local and provincial governments have doubled down on the central governments subsidy-heavy industrial policies. Most recently, in June 2022, Shenzhen announced the Action Plan for Cultivating and Developing Intelligent Robot Industry Clusters and in June 2023, the Beijing Municipal government announced the Beijing Robot Industry Innovation and Development Action Plan (2023-2025). Subsidies have driven the adoption of robots by manufacturing firms: at least 21 cities and 5 provinces committed a total of 6 billion USD by 2019. In Dongguan alone, 4,653 “machine-for-human” projects were initiated since 2014, providing investments of up to 8.2 billion USD by 2023. The city’s 200 million yuan annual fund to introduce industrial robots reimbursed manufacturing firms for 10-15 per cent of expenses for new equipment. Guangdong, in 2015, announced a plan to replace humans in factories with robots: more than 2,000 manufacturers signed up for this initiative. By 2016, the province had more than 60,000 industrial robots, one-fifth of the country’s total. The efforts by provincial and local governments have been effective in accelerating the adoption of robots.

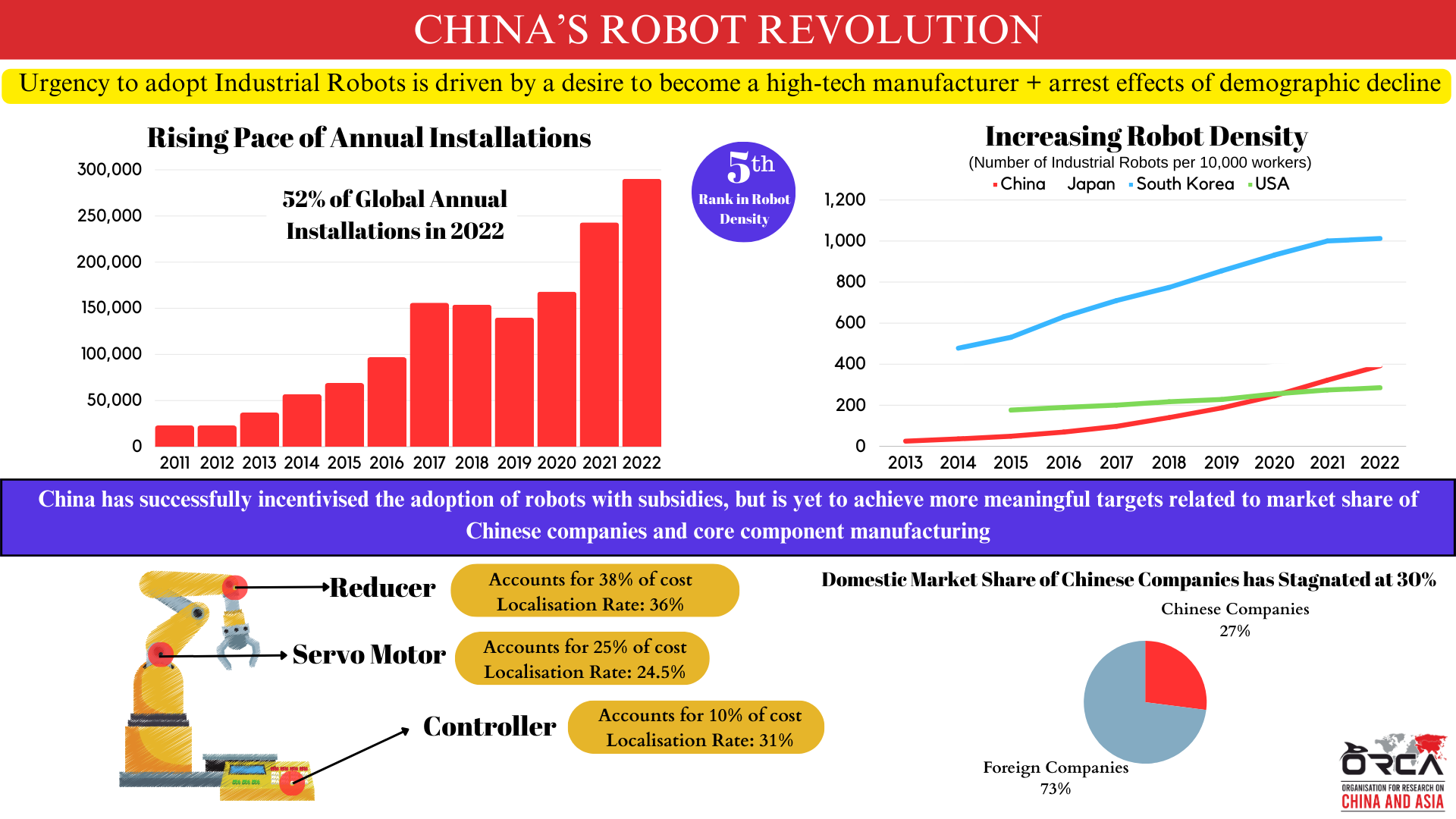

China has been the largest market for industrial robots since 2013 and accounted for 52% of all new installations in 2022. The robot density rate (number of industrial robots per 10,000 workers) in China, a metric for automation, has grown from 97 robots per 10,000 workers in 2017 to 392 in 2023. This should come as no surprise given that China is the manufacturing hub of the world, and as a result, has the largest operational stock of robots. But China is yet to achieve other, more significant targets, in terms of self-sufficiency and core component manufacturing. This is proving harder for the Chinese government to do through subsidies.

Self-Sufficiency and Climbing the Value Chain

China has incentivised manufacturing firms to adopt robots but is yet to increase the market share of domestic manufacturers (MIC2025 target: 80 per cent by 2025) and increase the localisation of core component manufacturing (MIC2025 target: 70 per cent by 2025). Foreign robot manufacturers have enjoyed a combined market share of around 70 per cent over the last eight years and domestic manufacturers accounted for over 30% per cent in 2022, rising steadily from 17 per cent in 2015. China imported 2 billion USD worth of industrial robots, incurred a deficit of 1.39 billion USD in 2022 and is likely to continue to rely on imports over the next 3 to 5 years.

Chinese robot companies rely heavily on foreign companies for the supply of core components, like servo motors, reducers, and controllers. They account for over 70 per cent of the cost of industrial robots. Japanese, Taiwanese, and European companies supply 70 per cent of servo motors and 85 per cent of high-precision reduction drives for China-made robots. Moreover, China-made robots have inferior algorithms that operate the controllers in a robot, which are responsible for stability and accuracy. As a result, they suffer from higher failure rates compared to foreign made robots and are mainly employed in low precision manufacturing.

To climb the value chain and bridge the gap in quality between domestic and foreign manufacturers, industrial policies in China are attempting to secure access to technology used by robot manufacturers in advanced industrial nations. In some cases, the Chinese government and private companies are involved in the acquisition of foreign companies. For instance, Germany’s Kuka, leader in industrial robotics, was bought by Midea in 2016 for 5 billion USD and Zhejiang Wanfeng Technology Development purchased US-based robotics maker Paslin for 300 million. China is also leveraging the size of its market for industrial robots to establish joint ventures and research facilities with robot manufacturers; in 2022, Swiss robot manufacturer, ABB Robotics, and Chinese automotive parts supplier HASCO entered into a joint venture which involved opening an advanced robotics factory as well as a research and development centre.

But the challenge facing China’s industrial robotics sector isn’t just a technological one; it is also a human resource one. The adoption of robots and highly skilled workers are complementary, and companies have to hire more highly skilled workers after adopting robots. China is constrained by the limited availability of highly skilled professionals required to carry out the full range of operations to keep industrial robots working. The human resource problem in the industrial robotics sector mirrors a larger labour-related challenge facing China’s economy.

The Demographic Dimension

Industrial robots are a part of the Chinese governments answer to an immediate and pressing demographics problem: a shrinking working-age (15 – 64) population and rising wages. The shortage of labour is most acute in the manufacturing sector; according to a government document that identifies 100 occupations which have labour shortages, 41 were manufacturing related. The shortage of labour is forcing production lines in factories to consider automation, and since the working age population is projected to drop by over 20 per cent by 2050, industrial robots will be positioned to take up more repetitive mechanical work. The rising cost of labour in China has also pushed firms to consider automation: a study of industrial robots in China found that rising wages are positively correlated with robot adoption, increasing the probability of robot adoption by 3 percentage points.

Additionally, slowing Total Factor Productivity (TFP) growth is motivating the adoption of industrial robots. There is a positive relationship between robots and TFP: robots compensate for the shortage in labour, improve stability and decrease the defective rate from repetitive mechanical work, reduce economic losses by improving production safety, and generate higher productivity through high-tech characteristics. A study by the IMF, using prefecture level data from Japan, found that increases in robot density in manufacturing were associated not only with greater productivity but with local gains in employment and wages. Like with Japan and South Korea, the demographic decline and the drive for higher productivity in China are key drivers of demand for industrial robots over the next decade.

The Rise Ahead

Automation and the adoption of industrial robots in China is an inevitable trend, driven forward by the technological transformation of manufacturing and compelling demographic factors. However, narrowing access to foreign markets for technology and limited availability of high-quality human resources have emerged as bottlenecks for the further development of China’s industrial robotics market. Although there is a great deal of urgency in China’s attempts to become a high-tech manufacturer and its efforts are backed by generous subsidies, navigating these bottlenecks is inevitable and will require more than just state subsidies. Further progress requires cultivating high-quality human resources and fostering innovation-led growth to achieve larger and more meaningful objectives.

This article is the first of a series that examines the progress of the Made in China 2025 initiative.

Author

Rahul Karan Reddy

Rahul Karan Reddy is a Senior Research Associate at Organisation for Research on China and Asia (ORCA). He works on domestic Chinese politics and trade, producing data-driven research in the form of reports, dashboards and digital media. He is the author of ‘Islands on the Rocks’, a monograph about the Senkaku/Diaoyu island dispute between China and Japan. Rahul was previously a research analyst at the Chennai Center for China Studies (C3S). He is the creator of the India-China Trade dashboard and the Chinese Provincial Development Indicators dashboard. His work has been published in The Diplomat, East Asia Forum, ISDP & Tokyo Review, among others. He can be reached via email at [email protected] and @RahulKaranRedd1 on Twitter.