The military action in Venezuela operationalised by the United States to capture Nicolas Maduro has presented China a new geopolitical canvas upon which it must recast its foreign policy in Latin America. President Trump’s Operation Absolute Resolve launched large-scale strikes on Caracas on January 3 2026 before capturing Maduro, with the operation coming in hot on the heels of China’s third Policy Paper on Latin America and Caribbean. The timing of the strikes offers a stark contrast to Chinese policy planning in the Western hemisphere that has grown in a consistent, focused manner over decades. The results of this sustained engagement are clear in the Chinese policy paper on Latin America while articulating future economic and political interests, which should be read as a playbook for how Beijing cultivates influence in the US’ backyard.

However, an unmistakeable demonstration of America’s ability to alter the balance of power in its favour through armed force is a new variable for China’s foreign policy planning. The Trump administration’s intervention in Venezuela has shaken up the old geopolitical canvas on which China’s carefully planned diplomatic strategy was expected to bring dividends.

Tides of Change

China’s policy approach towards Latin America and the Caribbean has changed significantly over its paper’s three iterations in nearly two decades, growing in tandem with China’s economic capacities and reflecting its expanding foreign policy outlook. The latest document released in December 2025 is longer than previous versions, more comprehensive and goes beyond the rhetoric of South-South solidarity characterising the first paper in 2008.

The 2025 paper marks many firsts; references the Global South (全球南方) and inclusive economic globalization (普惠包容的经济全球化), credits Xi Jinping for major initiatives, offers development assistance without political conditions and promises to implement Global Initiatives (GSI, GDI, GCI & GGI). It is also the clearest expression of China’s expectations from countries in the region; the sequencing and consolidation of sections within the paper present political alignment on core interests (like Taiwan) as the main priority. The paper exhibits continuity with previous versions by doubling down on the economic and commercial value proposition of China as a comprehensive development partner, presented in the form of “five major projects” (五大工程).

New Realities

Evolving but enduring at the same time, China’s policy planning for Latin America will nonetheless have to take on pragmatic recalibrations after the US military action in Venezuela. It appears largely unsuited to counteract the Trump administration’s willingness to intervene more proactively in the Western hemisphere, expressed in the recently released US National Security Strategy (NSS). A new US posture for Latin America with the resuscitation of the Monroe doctrine pledges to deny strategic assets to adversaries like China and readjust US global military posture to focus on the Western hemisphere.

China’s policy planning for the region offers no contingencies for the US’s newfound appetite for military intervention and ability to rapidly impose overwhelming costs on Latin American governments. At the same time, Beijing has no interest or capacity to exercise hard power options in the Western hemisphere, leaving its foreign policy passive and reactive to unpredictable US military action against China’s partners in the region.

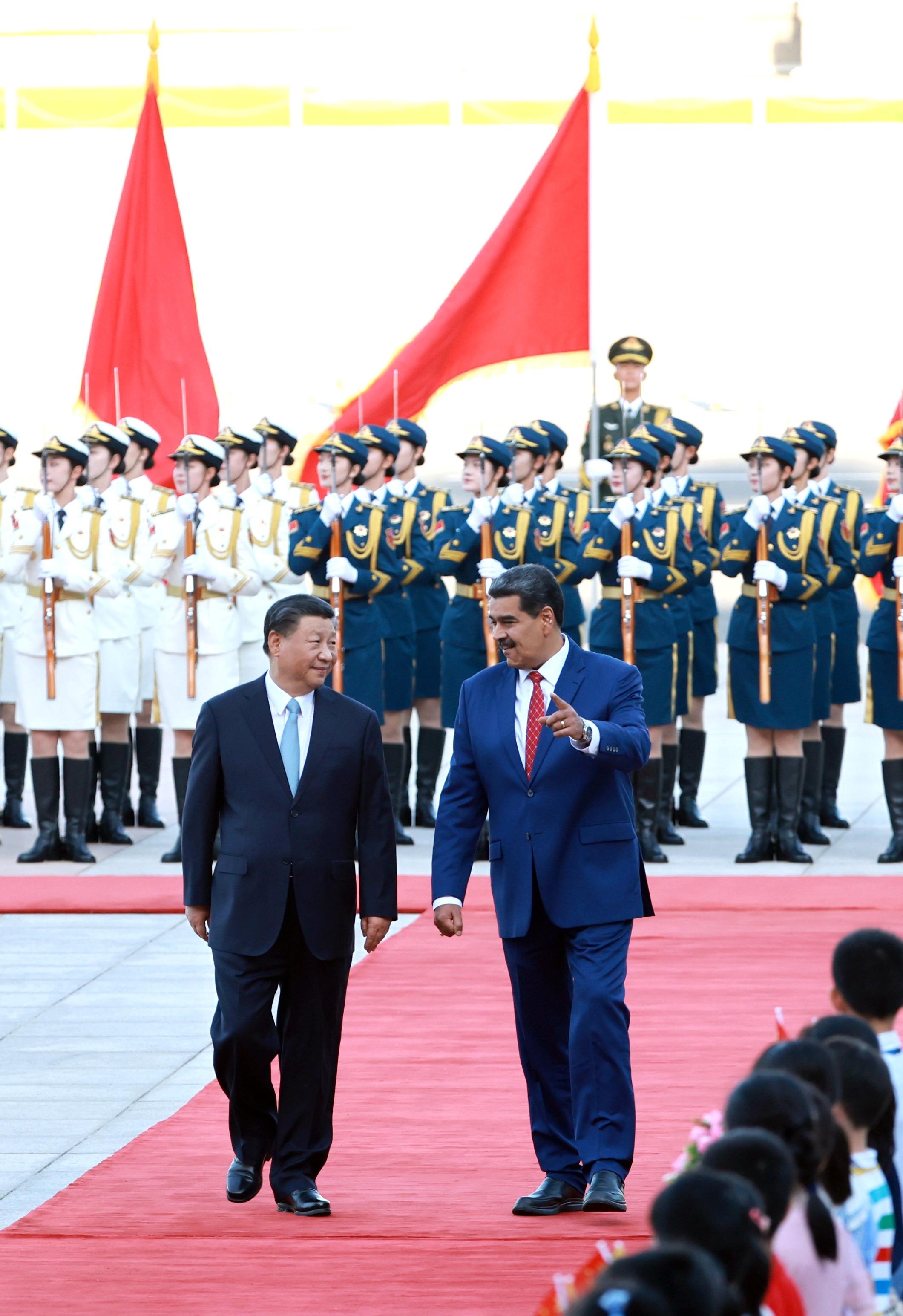

It is not just China’s Latin America policy paper that appears lacking following the US intervention in Venezuela. The potency of an “all-Weather Strategic Partnership”, the highest level of strategic partnership China has with countries like Pakistan and Russia, is also called into question. China’s all-weather strategic partnership with Venezuela was hailed by Nicolas Maduro during his meeting with China’s special representative for Latin America, Qiu Xiaoqi, just hours before his abduction by US forces, as “Unbreakable and in all weather!”.

`But the US military action in Venezuela has revealed the somewhat limited counterbalancing value of an all-weather strategic partnership to Latin American governments. Furthermore, with the NSS in place to curtail China’s presence in Latin America, a high-level strategic partnership with China is a lightning rod, inviting US pressure or worse. The appeal of China’s foreign policy overtures in the region is blunted by ongoing risk of regime-changing U.S military action.

Shifting political tides across the region are also shaping a new geopolitical canvass for Beijing’s foreign policy to navigate. The return of right-wing governments in Argentina, Chile and Honduras, and existing right-wing governments in Ecuador and Bolivia, signal a shift in the regional political landscape. Unlike left-wing governments like that of Nicolas Maduro who shared an ideological affinity with China, right-wing governments like that of Javier Milei in Argentina are moving away from China. Most recently, Argentina scrapped plans to build a radio telescope with China after receiving a financial bailout package from the US. Although left- and right-wing governments in the region engage with China on the basis of commercial and pragmatic considerations, rather than on entirely ideological grounds, the ideological alignment with governments in Latin America that supported China’s foreign policy outreach is a fading advantage.

Jeopardy and Risk

China’s foreign policy planning document draws a blank on how to manage externalities of US military action that directly impinge on its commercial interests and investments in Venezuela. Maduro’s removal evokes memories of China’s experience in Libya; leaving behind billions in investments after the top leader was removed. China’s 62 billion USD of loans and investments since 2007 were being repaid by Caracas through oil, which accounts for 5% of China’s total oil imports. But now, Beijing faces uncertainty on several fronts; the interim government of Delcy Rodriquez could declare oil sales to China (and debt) illegal, or the US could demand that Beijing start using US dollars for its purchases of oil. Moreover, the interruption of Venezuelan Merey crude flows to “teapot” refiners in China may force them to seek alternative suppliers or settle for less after inventories run out. The implications for China’s energy security are compelling, evidenced by Beijing’s strong condemnation of US actions as “hegemonic behaviour” (霸权行径), and demands that China’s legitimate interests be protected. The fallout is not limited just to Chinese energy investments.

China is heavily involved in Venezuela’s telecommunications sector; companies like Huawei and ZTE built the country’s 4G network and national ID card system. A pro-US administration, or one acquiescing to US pressures to limit Chinese investments, could cancel contracts and restrict Chinese participation in ports, railways and critical infrastructure. The US NSS commitment to “make every effort to push out foreign companies that build infrastructure in the region” is likely to seriously limit the advance of Chinese commercial and foreign policy interests.

What Next: Policy Planning for Latin America

China’s foreign policy planning for Latin America is forced to confront the new reality of a US administration committed to decisively altering the balance of power. It must also come to terms with the emergence of right-wing governments across the region, which could complicate political engagement and outreach. With the Venezuela action, Beijing’s economic interests are poised awkwardly, and the implications for China’s region-wide engagement are wide-ranging.

China may have to undertake a considered recalibration of its foreign policy engagement in Latin America to preserve the appeal of its strategic partnerships, durability of interests, and coherence of narratives on Global South solidarity. Its latest foreign policy paper for Latin America appears insufficient to face the mounting uncertainty and risk emanating from a new US security posture for the region. For its long-game to play out favourably, Beijing may have to factor in spasmodic upheavals that could fracture favourable regional dynamics in the near future.

Image: China Daily

Author

Rahul Karan Reddy

Rahul Karan Reddy is Senior Research Associate at Organisation for Research on China and Asia (ORCA). He works on domestic Chinese politics and trade, producing data-driven research in the form of reports, dashboards and digital media. He is the author of ‘Islands on the Rocks’, a monograph on the Senkaku/Diaoyu island dispute between China and Japan. He is the creator of the India-China Trade dashboard, the Chinese Provincial Development Indicators dashboard and co-lead for the project ‘Episodes of India-China Exchanges: Modern Bridges and Resonant Connections’. He is co-convenor of ORCA’s annual conference, the Global Conference on New Sinology (GCNS) and co-editor of ORCA’s daily newsletter, Conversations in Chinese Media (CiCM). He was previously a Research Analyst at the Chennai Center for China Studies (C3S), working on China’s foreign policy and domestic politics. His work has been published in The Diplomat, 9 Dash Line, East Asia Forum, ISDP & Tokyo Review, among others. He is also the Director of ORCA Consultancy.