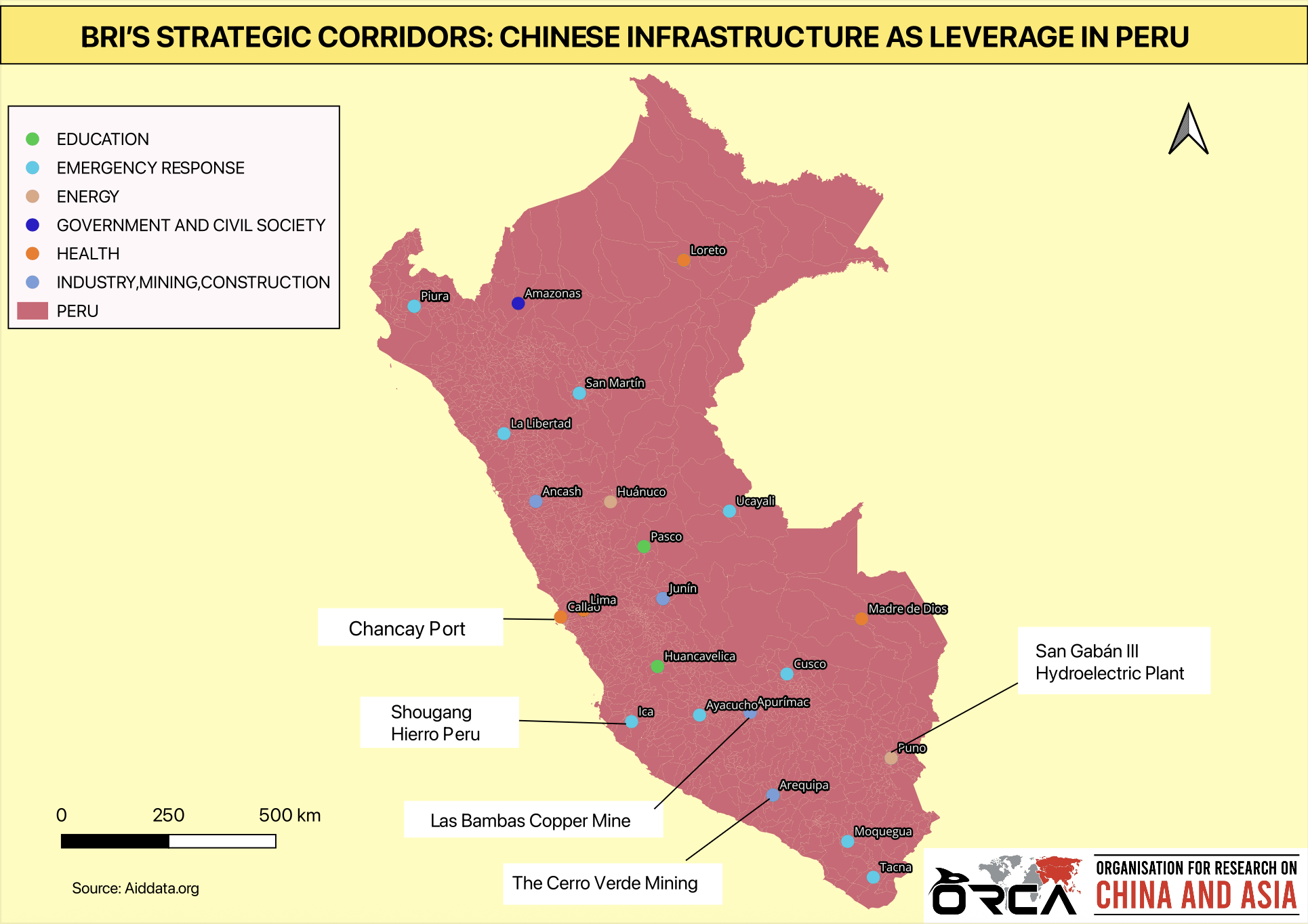

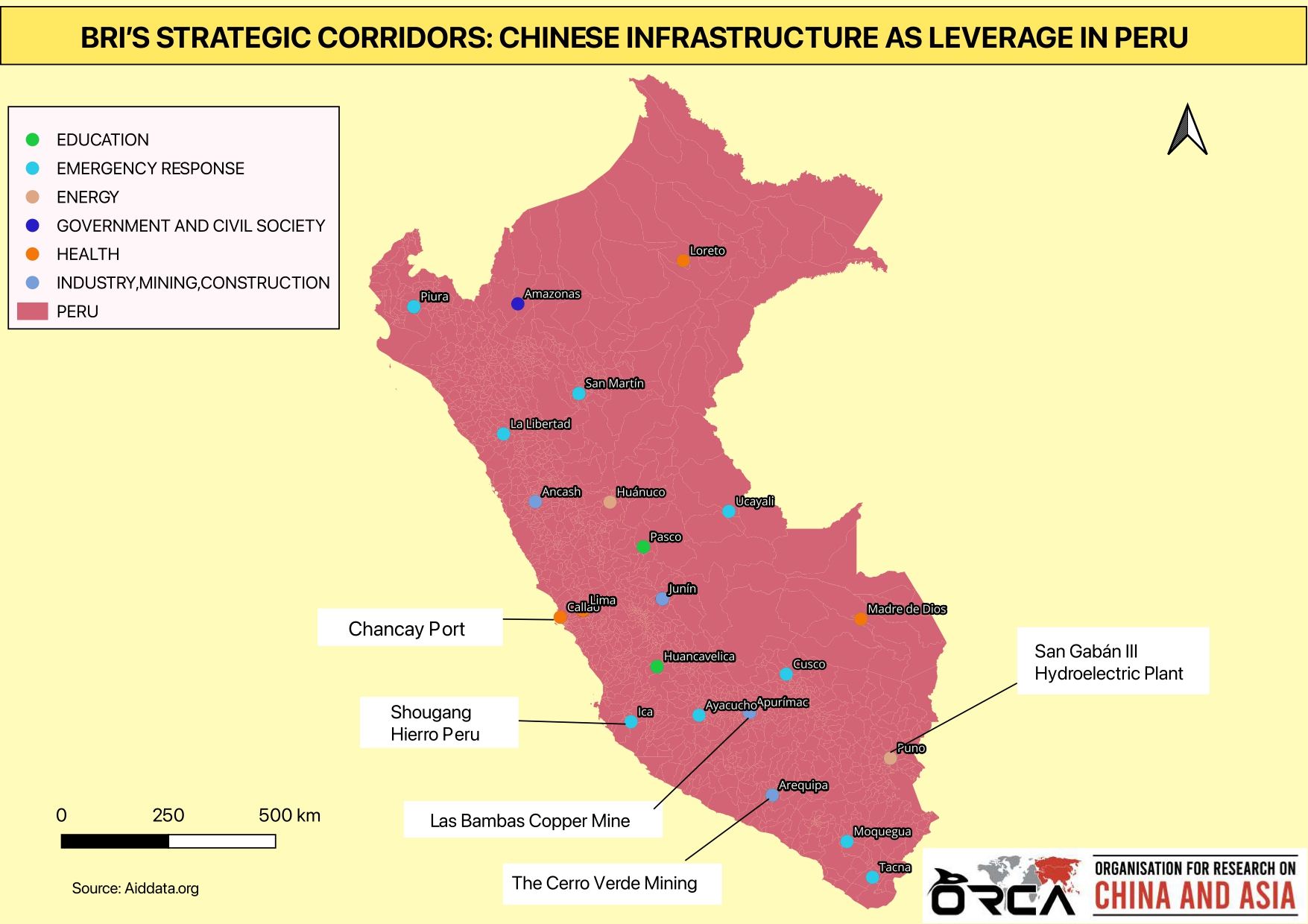

Since signing a memorandum of understanding to join China’s Belt and Road Initiative (BRI) in April 2019, Peru has witnessed a surge of China-backed infrastructure projects that extend well beyond the mere construction of roads and ports. Financed chiefly by Chinese policy banks and developed by state-owned enterprises, these megaprojects serve dual economic and strategic purposes: securing critical mineral supplies for China’s green transition, and forging alternative maritime and overland corridors that challenge traditional US influence in Latin America.

https://orcasia.org/allfiles/PERU_BRI_03.pdf

Strategic Sectors & Financing Channels: Key Projects and Actors

China’s economic footprint in Peru under the Belt and Road Initiative (BRI) is defined by high-stakes infrastructure and extractive projects, nearly all dominated by state-owned enterprises (SOEs) and policy banks. Below are the most significant ventures, along with the key entities leading them:

1. Chancay Megaport

The Chancay terminal, situated some 80 km north of Lima, is jointly operated by COSCO Shipping Ports (60 % ownership) and the Peruvian mining group Volcan (40 % ownership). The rail project connecting the port to markets in Brazil is estimated to cost US $3.5 billion. COSCO Shipping Ports planned an initial investment of US $1.2 billion for the project’s first phase. Upon completion, the port will feature 15 berths capable of handling over one million Twenty-foot Equivalent Unit (TEU) per annum, embedding a “Maritime Silk Road” anchor on the Pacific coast that reduces logistics costs by an estimated 20 % and bypasses traditional US-controlled choke points such as the Panama Canal.

2. Las Bambas Copper Mine

Las Bambas is a joint venture project operated by MMG, which holds a 62.5% stake. The remaining ownership is divided between Guoxin International Investment Co. Ltd (a wholly-owned subsidiary with 22.5% stake) and CITIC Metal Co. Ltd (15.0%). The mine, located in Apurímac, is financed by the China Development Bank (CDB) (US $4.1B), Industrial and Commercial Bank of China (ICBC) (US $2.9B), and Bank of China (BOC) (US $1.5B). Producing 2% of global copper—critical for China’s electronics and renewable energy sectors—the mine relies on BRI-linked infrastructure, including a dedicated mineral haulage road to the Port of Matarani.

3. Shougang Hierro Peru

Beijing's Shougang Group controls Peru's largest iron ore deposit, located approximately 530 kilometers from Lima in the district of Marcona, Nasca province, Ica Region. In 1992, Shougang Group acquired 98.4% of Hierro Perú's shares and permanent exploitation rights. The planned investment for this project totals approximately US $1 billion. The mine supplies 10% of Peru's iron exports to China, supporting Beijing's steel industry. In 2017, Shougang Hierro Peru, in coordination with the Association of Chinese Enterprises in Peru, funded the rental of vehicles and construction machinery for use in the Ica Region. These resources were subsequently provided to the local government for road repairs following significant flooding and natural disasters earlier that month.

4. San Gabán III Hydroelectric Plant

The San Gabán III hydroelectric project was initially developed by Hydro Global Perú S.A.C., a joint venture between China Three Gorges (CTG) (50% stake) and Energías de Portugal (50% stake). Located in San Gabán District, Carabaya Province, and Puno Department, the project secured a US$365 million loan from the China Development Bank (CDB), covering about 84% of its total capital expenditure. This loan came with concessional terms, including a 19-year tenor and a grace period. In July 2022, Energías de Portugal S.A. sold its 50% equity stake in Hydro Global Perú S.A.C. to China International Water & Electric Corporation, a subsidiary of the China Three Gorges (CTG) Group, for approximately EUR 68 million. Once operational, the facility's 209 MW capacity is expected to generate over 1,000 GWh of clean energy annually.

5. The Cerro Verde Mining Expansion

The Cerro Verde mining expansion, one of the largest copper projects in Peru, secured a US $1.8 billion syndicated loan that notably included the Industrial and Commercial Bank of China (ICBC) alongside global banking giants such as MUFG, HSBC, and BNP Paribas—signals China's strategic financial positioning in key extractive industries. The project, valued at US $4.6 billion, aimed to triple concentrator capacity at the open-pit copper, molybdenum, and silver mine near Arequipa from 120,000 to 360,000 tonnes per day. ICBC’s participation in the loan syndicate—despite being a minority player—aligns with broader BRI trends of embedding Chinese banks in large-scale infrastructure and resource ventures across Latin America, often in tandem with Japanese and European institutions to mitigate risk and gain local legitimacy. This collaborative financial architecture exemplifies the BRI’s flexible model of engagement through multilateral lending mechanisms, allowing Chinese capital to secure influence in Peru’s mineral value chains without direct ownership or construction roles.

Infrastructure as Geopolitical Leverage

`1. Pacific Projection

The Chancay Megaport epitomises China’s strategy to reconfigure Pacific maritime connectivity dynamics. Operated by COSCO Shipping, this deep-water hub will halve shipping times between Shanghai and Peru, deliberately bypassing the U.S.-influenced chokepoints. By anchoring a direct Asia-South America corridor, China not only erodes Washington’s logistical hegemony but also gains a potential dual-use asset; its 1.8 km wharf could support naval logistics, like the BRI port of Hambantota. This positions Peru as China’s gateway to the Pacific, challenging traditional transit routes.

2. Commodities Access

China’s infrastructure push is intrinsically linked to resource corridors, ensuring dominance over strategic supply chains. Highways from the Las Bambas mine funnel copper to ports, while the San Gabán III dam powers extraction sites. Rare earth exploration in the Andes and lithium concessions in salt flats further secure minerals critical for China’s tech sector, reducing reliance on Australia or Africa. Simultaneously, Chancay’s cold-storage facilities enable agricultural exports like Peruvian avocados and quinoa, diversifying China’s food sources away from U.S.-dominated markets. These projects create a closed loop: Chinese-built infrastructure extracts and exports resources to China.

3. Diplomatic Geometry

Peru navigates a delicate pivot between Chinese capital and Western frameworks. While embracing BRI investments, it maintains free-trade agreements with the U.S. and EU—a balancing act reflecting “pragmatic multialignment”. Recent political shifts add nuance: leftist President Castillo (2021–2022) initially threatened mining nationalisation but later upheld Chinese contracts; his successor Boluarte now accelerates BRI projects while endorsing the U.S.-led Americas Partnership for Economic Prosperity (APEP). This duality exposes Peru’s tightrope walk: leveraging Chinese infrastructure finance without alienating Western partners, even as U.S. naval deployments near Chancay signal growing unease.

The BRI in Latin America’s Emerging Multipolarity

China’s infrastructure footprint in Peru—from ports to fibre-optic networks—epitomises the hemisphere’s accelerating power shift. With billions of dollars committed, Beijing transforms Peru into a strategic beachhead, reducing Latin America’s historical dependence on Washington. Yet this “multipolarity” is contested: the U.S. counters through APEP’s trade frameworks and security alliances, framing Chinese loans as debt traps. Peru’s trajectory mirrors regional tensions—it exploits U.S.-China rivalry for investment but faces grassroots backlash against extractive projects and concerns over sovereignty. Crucially, the outcome hinges on whether BRI enables structural autonomy (e.g., value-added industries) or reinforces commodity dependency. As Peru hedges between powers, its choices will define whether multipolarity fosters development or merely swaps one hegemon for another.

Author

Melany Rodriguez

Melany Rodriguez is a final-year International Relations student at the Pontifical Catholic University of Peru (PUCP). She has gained experience through academic research, participation in international seminars, and volunteering with multicultural teams. Her thesis focuses on the Chinese diaspora in Peru and its impact on the country’s foreign policy toward China, reflecting her strong interest in diplomacy, international cooperation, and Asia–Latin America relations. Melany is a native Spanish speaker, fluent in English, and is currently studying Japanese. She is also at an intermediate level in Mandarin through her coursework at the Confucius Institute in Peru.