Click here to view the full map.

On April 4, China’s Ministry of Commerce imposed export restrictions on seven rare earth elements (REEs) and magnets used in the defense, energy and automotive sectors in response to the U.S. President Donald Trump’s tariff action on Chinese products. The directive, issued jointly by China’s Ministry of Commerce and the General Administration of Customs, placed strict licensing requirements on the export of heavy rare earth metals like samarium, gadolinium, terbium, dysprosium as well as their oxides, alloys and associated compounds. This move sent ripples across global supply chains, particularly in sectors reliant on REEs.

The strategic significance of rare earth minerals has increased due to the global shift towards electric vehicles (EVs), green energy and modern technologies. With the growing need for green technology like wind turbines, energy storage systems and EVs, these REEs are becoming critically important for future economic growth and geopolitical strategies.

China has emerged as the industry leader in metals and rare earths mining and processing, contributing to around 90 percent of rare earth refining. By gaining access to overseas mining operations, integrating supply networks and rallying support from the public and commercial sectors, China has been attempting to outmaneuver Western businesses in mineral-rich sectors.

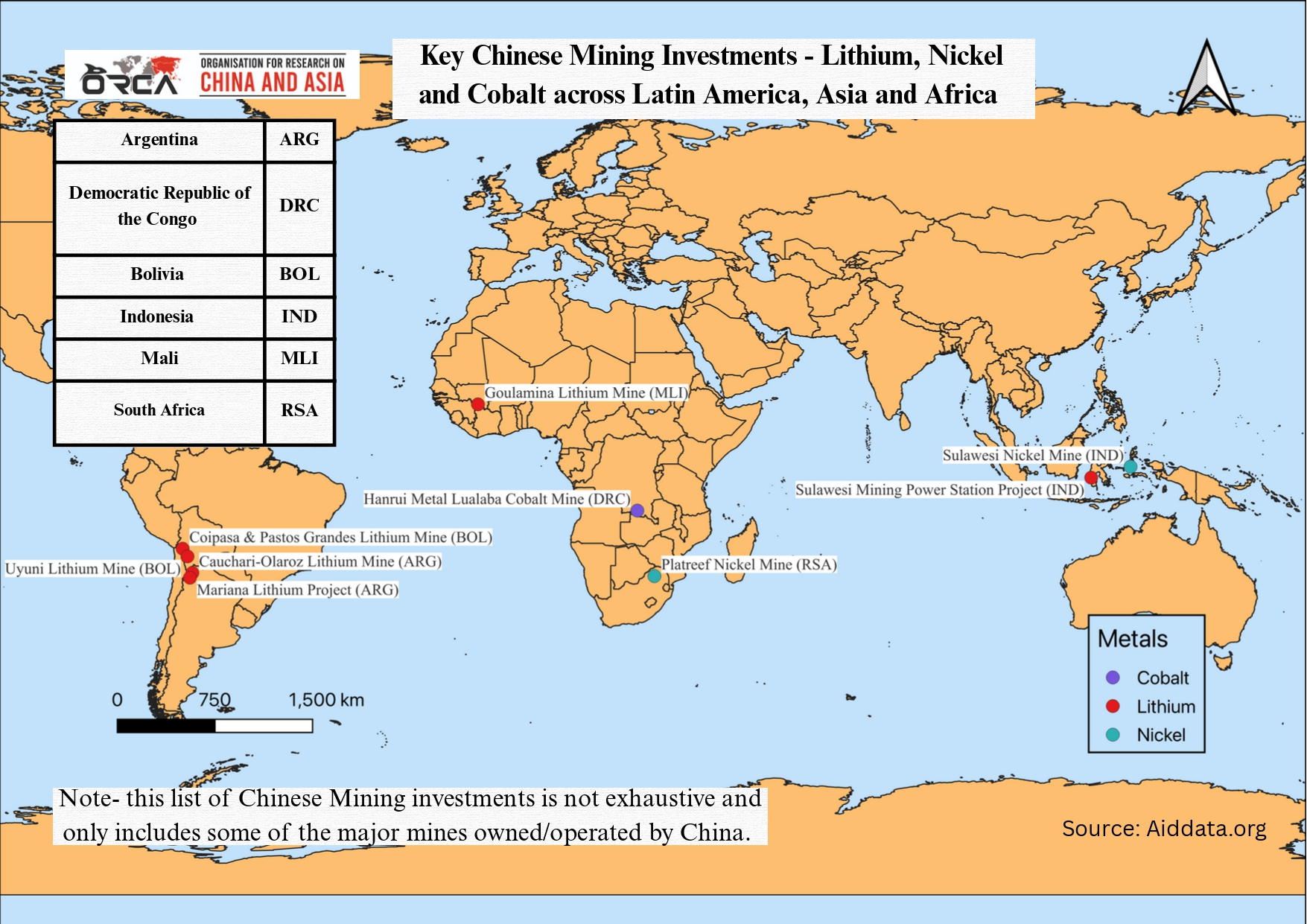

Its approach fulfills two functions: strengthening geopolitical clout and ensuring a reliable supply of metals for its indigenous high-technology industry. China's international rare earth investment is primarily concentrated in the Global South; Africa, Asia and Latin America. These regions are well-known for their abundant undiscovered metals. Africa has abundant cobalt, lithium, and nickel reserves, all of which are required for the production of batteries and electrical equipment. Indonesia is an important destination in Asia because of its abundant nickel resources. Latin America, particularly the "Lithium Triangle" of Bolivia, Argentina and Chile, is a major source of lithium.

China’s strategy involves large-scale, state-backed investments coordinated through institutions like the state banks and state-owned enterprises (SOEs). These investments focus on regions with governance gaps—such as the DRC, Indonesia, and Bolivia—where China can operate with fewer regulatory hurdles. Projects are structured under initiatives like the Belt and Road, ensuring vertically integrated presence from extraction to processing. The geographic diversification of mining investments further insulates China from regional disruptions and strengthens its geopolitical leverage in mineral diplomacy. By doing so, China mitigates supply chain risk, secures low-cost raw materials, and maintains flexibility in procurement.

This strategy provides China with short-term economic benefits along with long-term supply chain security. It also positions the country to capitalize on future export opportunities as Western nations scale up clean energy adoption.

However, this model is not without risks. China's mineral acquisition policy faces enormous obstacles from mounting political resistance, environmental concerns, and rising resource nationalism. Protests against labor conditions and environmental destruction are on the rise across Africa. Similarly, in Indonesia, local groups have expressed rising concern about contamination from nickel processing. Thus, China's rare earth dominance— although secured through coordinated state-backed investments and global supply chain integration, has also been facing challenges which may limit the success of its supply chain's resilience.

Author

Vidisha Jain

Vidisha Jain is an undergraduate student at FLAME University, majoring in Psychology with a minor in International Studies. She is currently doing her Summer Internship Program with ORCA as a research intern.

Yuvraj Sindhwani

Yuvraj Sindhwani is currently pursuing an undergraduate degree at FLAME University, with a major in International Studies and a minor in Advertising and Branding. He is presently doing his Summer Internship Program (SIP) at ORCA, where he is working as a research intern.

Lavanya Vadehra

Lavanya Vadehra is an undergraduate student at FLAME University, majoring in International Studies with a minor in Public Policy. She is currently doing her Summer Internship Program with ORCA as a research intern.